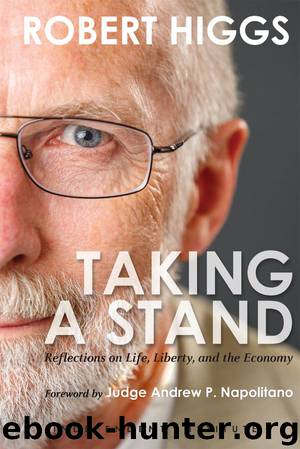

Taking a Stand: Reflections on Life, Liberty, and the Economy by Robert Higgs

Author:Robert Higgs [Higgs, Robert]

Language: eng

Format: epub

Publisher: Independent Institute

Published: 0101-01-01T00:00:00+00:00

* * *

1. Federal Reserve Bank of St. Louis, “Monetary Data: Categories,” http://research.stlouisfed.org/fred2/categories/24.

47

The Euthanasia of the Saver

IN CHAPTER 24 of The General Theory of Employment, Interest and Money1 (1936), John Maynard Keynes laid out his screwball idea that capital might soon become, or be made to become, no longer scarce; hence no payment would have to be made to induce people to save, and that condition would be splendid inasmuch as it would entail the “euthanasia of the rentier.” This stuff really must be seen to be believed; here is the meat of Keynes's discussion in his own words:

The justification for a moderately high rate of interest has been found hitherto in the necessity of providing a sufficient inducement to save. But we have shown that the extent of effective saving is necessarily determined by the scale of investment and that the scale of investment is promoted by a low rate of interest, provided that we do not attempt to stimulate it in this way beyond the point which corresponds to full employment. Thus it is to our best advantage to reduce the rate of interest to that point relative to the schedule of the marginal efficiency of capital at which there is full employment.

There can be no doubt that this criterion will lead to a much lower rate of interest than has ruled hitherto; and, so far as one can guess at the schedules of the marginal efficiency of capital corresponding to increasing amounts of capital, the rate of interest is likely to fall steadily, if it should be practicable to maintain conditions of more or less continuous full employment—unless, indeed, there is an excessive change in the aggregate propensity to consume (including the State).

I feel sure that the demand for capital is strictly limited in the sense that it would not be difficult to increase the stock of capital up to a point where its marginal efficiency had fallen to a very low figure. This would not mean that the use of capital instruments would cost almost nothing, but only that the return from them would have to cover little more than their exhaustion by wastage and obsolescence together with some margin to cover risk and the exercise of skill and judgment. In short, the aggregate return from durable goods in the course of their life would, as in the case of short-lived goods, just cover their labour costs of production plus an allowance for risk and the costs of skill and supervision.

Now, though this state of affairs would be quite compatible with some measure of individualism, yet it would mean the euthanasia of the rentier, and, consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity-value of capital. Interest today rewards no genuine sacrifice, any more than does the rent of land. The owner of capital can obtain interest because capital is scarce, just as the owner of land can obtain rent because land is scarce. But whilst there may be intrinsic reasons for the scarcity of land, there are no intrinsic reasons for the scarcity of capital.

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

International Integration of the Brazilian Economy by Elias C. Grivoyannis(106924)

The Radium Girls by Kate Moore(12000)

Turbulence by E. J. Noyes(8001)

Nudge - Improving Decisions about Health, Wealth, and Happiness by Thaler Sunstein(7676)

The Black Swan by Nassim Nicholas Taleb(7085)

Rich Dad Poor Dad by Robert T. Kiyosaki(6568)

Pioneering Portfolio Management by David F. Swensen(6266)

Man-made Catastrophes and Risk Information Concealment by Dmitry Chernov & Didier Sornette(5977)

Zero to One by Peter Thiel(5759)

Secrecy World by Jake Bernstein(4724)

Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance by Janet Gleeson(4441)

The Age of Surveillance Capitalism by Shoshana Zuboff(4264)

Skin in the Game by Nassim Nicholas Taleb(4223)

The Money Culture by Michael Lewis(4166)

Bullshit Jobs by David Graeber(4161)

Skin in the Game: Hidden Asymmetries in Daily Life by Nassim Nicholas Taleb(3972)

The Dhandho Investor by Mohnish Pabrai(3739)

The Wisdom of Finance by Mihir Desai(3714)

Blockchain Basics by Daniel Drescher(3564)